If you’ve ever come across the mysterious “WUVISAAFT” charge on your bank statement, you may have wondered what it means. WUVISAAFT is an acronym that represents a specific type of financial transaction, and understanding its components can help you make sense of this charge.

WUVISAAFT is What?

WUVISAAFT is an acronym that stands for several key elements:

- WU: This refers to Western Union, the well-known financial services and communications company that specializes in money transfer services.

- Visa: This indicates that a Visa credit or debit card was used for the transaction.

- AFT: This stands for “Account Funding Transaction,” which describes the nature of the transaction – moving money from one account to another.

By breaking down the WUVISAAFT acronym, we can see that this charge represents a money transfer made through Western Union using a Visa card to fund an account.

Wester Union (WU)

Western Union is a renowned leader in the money transfer industry, offering reliable and efficient services for both individuals and businesses. Whether you need to send money locally, nationally, or internationally, Western Union has become a go-to platform for many people and organizations. The company’s expertise in facilitating these types of financial transactions is a key reason why the “WU” component is included in the “WUVISAAFT” charge.

Visa

The “Visa” element in “WUVISAAFT” signifies that a Visa credit or debit card was used to complete the transaction. It’s important to note that Western Union does not necessarily have to be the issuer of the Visa card. Customers can use their own Visa cards, whether it’s a credit or debit card, to make transactions through Western Union’s services.

AFT

The “AFT” in “WUVISAAFT” stands for “Account Funding Transaction”. This refers to the act of moving money from one account, such as a bank account or a credit card, to another account, often to pay bills, settle debts, or send money to friends or family members.

What Unites Them All?

The ‘WUVISAAFT’ charge connects Western Union, your Visa or debit card, and the process of transferring money. Let’s break down how these elements work together in your transactions.

Your Visa or debit card plays a crucial role. When you initiate a transfer through Western Union, they withdraw the funds from the account linked to your card. Western Union doesn’t have to issue the card; you can use any Visa credit or debit card you have. The card simply acts as a bridge, moving money from your account to the recipient’s.

The “VISA” in “WUVISAAFT” indicates the transfer was made with a Visa card. The “AFT” stands for Account Funding Transaction, which describes the type of transfer.

Visa AFT services, like those offered by Western Union, rely on the Visa Direct network. This network ensures secure, instant transfers between accounts, making account funding transactions quick and efficient.

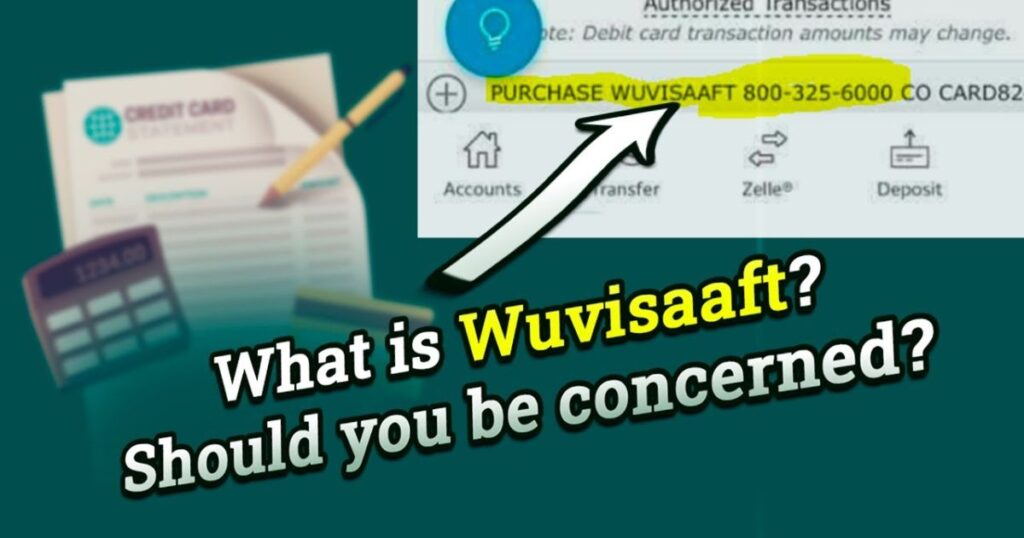

The WUVISAAFT Fee Shows Up on My Bank Statement in What Way?

Reading your bank statement can sometimes feel like decoding a foreign language, especially when cryptic acronyms like “WUVISAAFT” pop up. So, how does this charge typically appear?

A ‘WUVISAAFT’ charge will show up as a line item on your transaction history, often with a negative symbol (such as ‘-$50.00’) to indicate a debit from your account. This fee occurs when you use a Visa card to send money through Western Union. Essentially, it represents a transfer between accounts, whether it’s to pay a bill, settle a debt, or send money to someone abroad.

When you see a ‘WUVISAAFT’ charge, think back to any transactions you made. If the amount seems off or you don’t recall making a transfer, it’s important to investigate further.

If you unexpectedly see a ‘WUVISAAFT’ fee, here’s what to do:

- Review your transactions: Double-check recent activity to confirm if you used Western Union services. Sometimes recurring or automatic transfers can slip our minds.

- Contact your bank: If you’re unsure about the transaction and Western Union can’t provide details, notify your bank. They can help dispute the charge and protect your account from potential fraud.

Staying aware of your bank statement is key to financial security. If you ever come across a ‘WUVISAAFT’ fee or any unfamiliar transaction, don’t hesitate to ask questions. It’s always better to be cautious when it comes to your hard-earned money.

Read More: Seo Agency in Usa Appkod: Top SEO Services for Success

Recognized “WUVISAAFT” Charge on My Bank Statement

Discovering an unfamiliar “WUVISAAFT” transaction on your bank statement can be unsettling. If you’re sure you haven’t used Western Union recently, here are a few possible reasons for the charge:

- Forgotten transaction: You may have made the transfer and simply forgotten, especially if it was an automatic or recurring payment.

- Bank error: Sometimes, transaction processing mistakes can lead to incorrect charges on your statement.

- Fraudulent activity: If you didn’t authorize the transaction, it could be the result of fraud. Someone may have accessed your card information and used it without your knowledge.

Here’s what to do if you find an unexpected ‘WUVISAAFT’ charge:

First Step: Check your transaction history.

Review your recent transactions to see if you can identify the Western Union money transfer that led to the “WUVISAAFT” charge. This can help you determine if the charge is legitimate or not.

Step Two: Get in touch with Western Union

If you can’t recall the transaction, contact Western Union’s customer support. They should be able to provide you with details about the transfer, which can either help you remember the transaction or confirm that it’s fraudulent.

Contact your card issuer in step three.

If the transaction still seems suspicious or Western Union cannot confirm the legitimacy of the charge, reach out to your card provider. Inform them of the “WUVISAAFT” charge and express your concerns. They can investigate the charge, initiate a dispute process if necessary, and offer guidance on protecting your account.

Step Four: Keep an eye on your account

Regularly review your bank statements and monitor your account for any other unfamiliar transactions. Prompt identification of unusual activity can help minimize potential harm.

Remember, your financial security is what matters most. Don’t hesitate to question suspicious charges and act promptly when necessary. It’s always wise to handle your hard-earned money with care.

Interpreting WUVISAAFT Charge Variations

The “WUVISAAFT” charge can appear on your bank statement in various formats, often with additional information accompanying the acronym. Here are some common variations and their meanings:

- WUVISAAFT 800-325-6000: The phone number (800-325-6000) belongs to Western Union’s customer service.

- WUVISAAFT CO: The “CO” stands for Colorado, which is the state where Western Union’s headquarters are located.

- WUVISAAFT 800-325-6000 COUS: This combines the customer service number and the location of Western Union’s headquarters (Colorado, United States).

- WUVISAAFT 800-325-6000, CO 80112: The “80112” is the zip code for Western Union’s office in Englewood, Colorado.

- PYMT Message sent 800-325-2000WUVISAAFT CO: This variation indicates that a payment (“PYMT”) was made through Western Union, with the headquarters address (CO) and customer service number included.

Understanding these variations can help you better interpret the “WUVISAAFT” charge on your bank statement and ensure that the transaction is legitimate and aligns with your financial history.

This article is accurate to the best of the author’s knowledge and is intended for informational or entertainment purposes only. It should not replace professional advice for commercial, financial, legal, or technological matters.

Explore More Business Articles…